The recently released Financial Inclusion Module, part of the November 2024 Permanent Multi-Purpose Household Survey (EPHPM), offers a current overview of how the Honduran populace engages with the official financial sector. This module was a joint effort by the National Institute of Statistics (INE Honduras), the National Banking and Insurance Commission (CNBS), and the Inter-American Development Bank (IDB). The survey encompassed 7,250 households, representing 26,576 individuals, and delivers highly pertinent statistics concerning access, use, and financial education. This information is particularly relevant given the ongoing political discussions surrounding credit regulation.

Credit utilization and its influencing elements

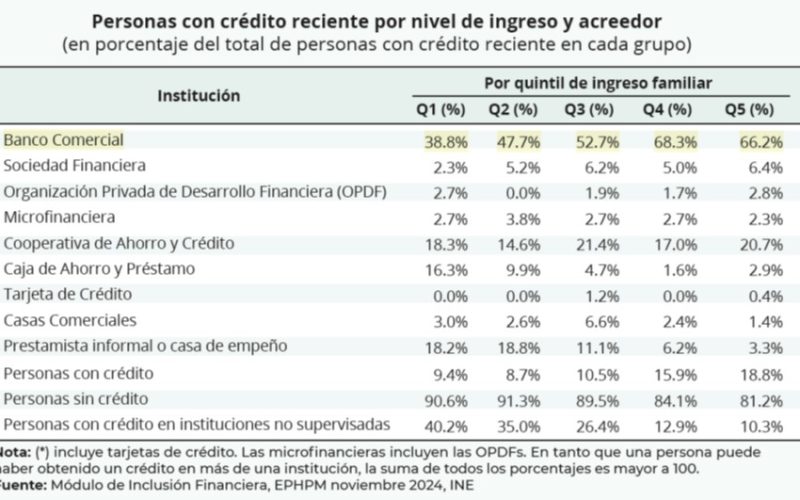

The document shows that credit use is directly correlated with income levels, increasing as one moves up the income quintiles. This pattern responds to structural factors such as payment capacity, effective demand, knowledge of financial offerings, financial education, and digital literacy.

The questionnaire contained inquiries regarding credit requests made over the past year, encompassing various origins: financial institutions, informal lenders, pawnshops, and businesses. For individuals who did not seek credit, the underlying cause was explored. The findings reveal that 91.3% of the justifications relate to a lack of necessity or perceived hazards: “I haven’t required it,” “I don’t fulfill the criteria,” and “Obtaining a loan is excessively perilous.” Conversely, the justification associated with being listed with the Credit Bureau, a point frequently raised in political discussions, constituted merely 0.7%, a statistic that underscores its minimal significance among the impediments to credit accessibility.

These results diverge from the perspectives of political figures, including the candidate from the governing LIBRE party, who has asserted that the Central Credit Registry restricts credit accessibility and has advocated for its removal. Statistical data indicates that the actual impediments to financial inclusion are more strongly linked to socioeconomic factors, educational attainment, and savings habits, alongside the perceived risk stemming from the prevailing economic conditions.

Financial inclusion and regional comparison

In terms of participation in the financial system, the survey reflects a level of banking penetration of 42% of the population over 15 years of age with some type of deposit account or electronic wallet. This data is consistent with information from the World Bank’s Global Findex 2025, which reports 42% for Honduras in 2024, placing the country below neighboring nations such as Costa Rica (71%) and Panama (64%). In addition, there has been a decline compared to pre-pandemic indicators from 2017, highlighting the structural challenges the country faces in terms of financial inclusion.

The research highlights that broadening the availability of credit and financial offerings necessitates evidence-based solutions, including financial literacy programs, bolstering savings mechanisms, and enhancing the overall business environment. Actions that entail the removal or alteration of credit data could lead to institutional regressions and increased obstacles for individuals currently outside the formal financial framework.

Organizational hurdles and the financial landscape

The financial inclusion module identifies the critical bottlenecks that limit credit expansion in Honduras. Beyond political discussions about the Credit Bureau, access to and use of credit is conditioned by household economic capacity, financial education, and risk perception in an environment marked by economic volatility and high levels of informal employment.

The data gathered by INE Honduras, CNBS, and the IDB offers crucial insights for developing public policies designed to enhance financial participation securely and sustainably, thereby preventing the implementation of actions not supported by verifiable information. The examination of the survey results corroborates that financial inclusion is a complex process influenced by multiple factors, with income, education, and economic foresight playing a more significant role than merely credit regulations.